Our History

Founded in 2019, LL & Sons provides consultancy services; worldwide, for most market sectors.

After spending years, in the corporate entity trenches, solving multidimensional problems, for our partners (our “clients“), LL & Sons (the “Consultancy“) noticed most clients were facing recurring patterns: a.i) Launching an initial momentum, a.ii) Benefiting from a certain growth, leading to; a.iii) Decreasing their risk mitigation policies, a.iv) Increasing physical inefficiencies, a.v) Increasing their level of financial leverages, and a.vi) Repeating i) to v) until reaching their business’ saturation point also known as a forced corporate restructuring.

Formulated this way, it can sound obvious to avoid those pitfalls, but within a centralized organization where: b.i) Multiple actors, at different levels of the hierarchy, are able to make decisions, b.ii) Within different space-time and corporate divisions, and b.iii) Representing multiple monetary scales; those micro problems (causes), can fly under the radars for years, before being noticed by either senior managers, the executive team, the BoD, and/or investors, micro problems which often lead to macro magnitude problems (effects), forcing a mandatory corporate restructuration.

Knowing that most individuals learn from observations of either: c.i) their own mistakes, c.ii) other people’s mistakes, and/or c.iii) serendipity. The consultancy understands that being proactively structured is not always possible, but that proactive restructuring is always a great business practice.

At LL & Sons, we also believe Proactive Qualitative and Quantitative Due Diligence also known as an Active Corporate Investigation, can assure continuous physical and financial risk mitigation and productivity increases, by detecting and correcting: d.i) potential litigious business practices, d.ii) physical inefficiencies, and d.iii) financial anomalies.

The founders of the consultancy decided to launch a different type of consulting services, based on different metrics than its competitors, which include: e.i) Econophysics, e.ii) Deep Multidimensional Analyses, e.iii) Interdependent Qualitative and Quantitative Due Diligence, and e.iv) Physical Data Structuring Methodologies.

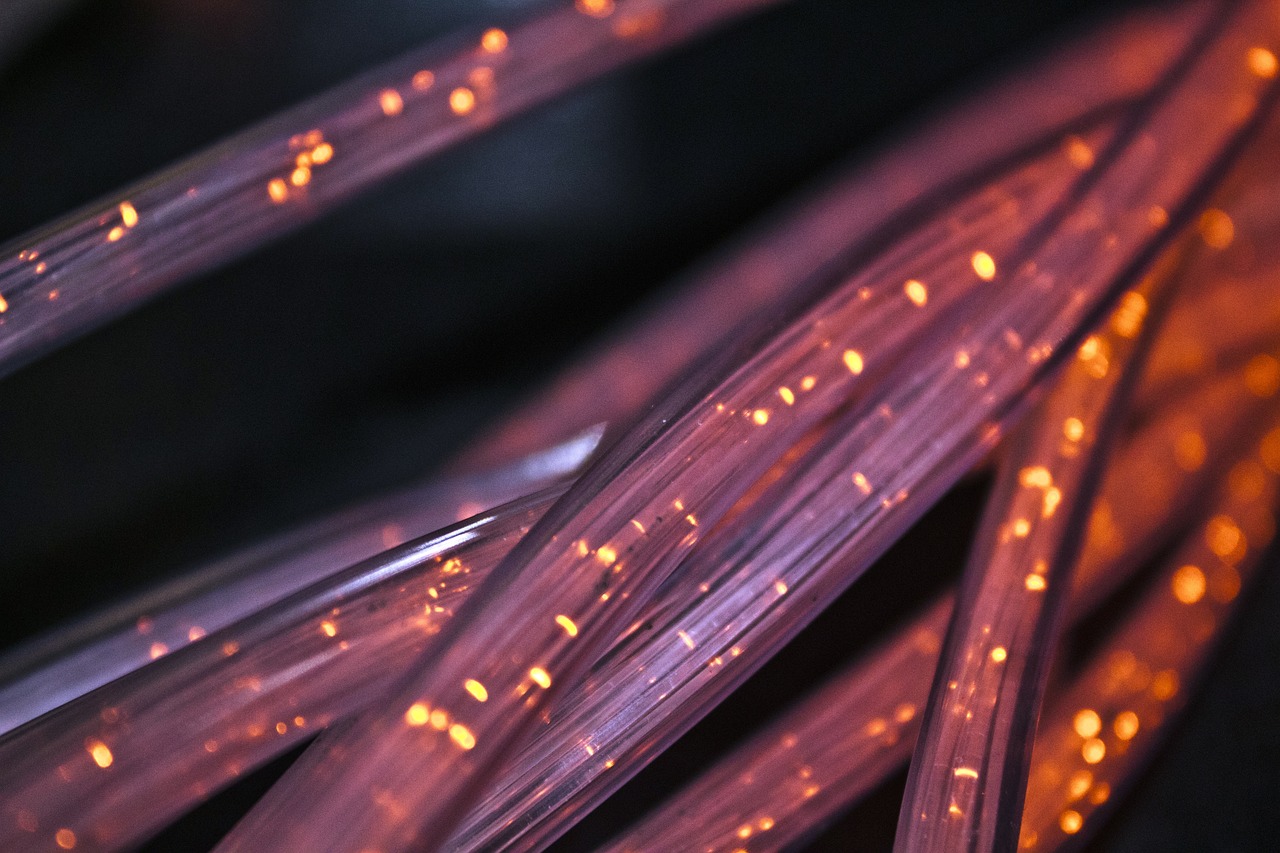

Offering our services mostly in the: f.i) Telecommunication, f.ii) Energy, f.iii) Technology, f.iv) Logistics, and f.v) Maintenance sectors, LL & Sons’ consultancy is able to offer its services in most market sectors.

*NOTE: The market sectors in which the consultancy doesn’t operate, are: g.i) Speculative markets (equity, bond, crypto/foreign currencies, derivatives, obligations, or any other financial/monetary instruments that doesn’t pass our Active Corporate Investigation tests), and g.ii) Gregarious trend markets (usually related to the fashion market).

Our Vision, our mission?

In today’s world, we can easily have access to information.

Meanwhile, too much information can blur a business management’s vision, lead to erratic and inefficient decision processes.

LL & Sons (the “Consultancy“) is here to help corporate entities discerning signals from noises.

The consultancy’s representatives analyze our partners (our “Clients“) business structure and practices, from the ground up, through the acquisition of hard facts, directly from the field; to structure the data, in order to make real time analyses and stress tests, which are then used to create, update and refine detailed recommendations.

LL & Sons is convinced that investors, BoDs, and management teams seek better data and greater productivity levels; while increasing asset protection and risk mitigation. We also want to help them: i) make structured decisions, and ii) ask the right questions during annual and shareholder meetings.

Why Us?

LL & Sons‘ (the “Consultancy“) representatives use proprietary Qualitative and Quantitative Value Investing Metrics, including: i) Physical risk, ii) Competitive advantage, iii) Risk Mitigation, iv) Business Saturation, v) Client’s Product v. the Services, Commodities, and Goods (SCG) index, vi) Inflation/Deflation coping mechanism, vii) Alternative resource adaptation, and many other valuable factors and variables; which are not commonly used within the average consultancy industry.

Our consultancy’s representatives’ proneness to speculative biases is highly mitigated; due to the fact that they are only authorized to deliver their analyses and/or recommendations after passing our proprietary Qualitative and Quantitative Due Diligence Test, followed by an approval from LL & Sons’ senior manager committee.

The consultancy always walks the extra mile, for its partners (its “clients“), in order to deliver its analyses and/or recommendations as fast as humanly possible.

Our oath is to: “Tell the truth, the whole truth, and nothing but the truth; even if it is unpleasant or difficult for clients.”

Which constitutes a major reason for investors to request our Qualitative and Quantitative Investigation services; before considering the acquisition of any financial instruments from either public or private corporate entities.